The Process

-Our team conducts deep market research to identify emerging submarkets with strong fundamentals.

-We leverage broker relationships to access off-market or early-stage opportunities.

-Focus is placed on value-add potential—properties with upside through renovations, operational efficiencies, or rent growth.

-We analyze:

1. Historical financials

2. Rent comps and occupancy trends

3. Physical inspections and third-party reports

-We model projected returns based on repositioning strategies and market dynamics.

-We secure financing through agency or bridge loans, backed by experienced key principals.

-Investors are invited to participate as Limited Partners (LPs), gaining passive ownership in a cash-flowing asset.

-Subscription documents and PPMs are shared, and capital is raised.

-Renovations and operational improvements begin, aligned with our value-add business plan.

-As rents increase and expenses are optimized, property value appreciates.

-Investors receive quarterly distributions from operating cash flow.

-We monitor market conditions to determine optimal timing for sale or refinance.

-Upon exit, investors receive their initial capital plus equity gains.

-Typical returns include:

1. Consistent cash flow during hold

2. Capital appreciation at exit

3. Potential tax advantages

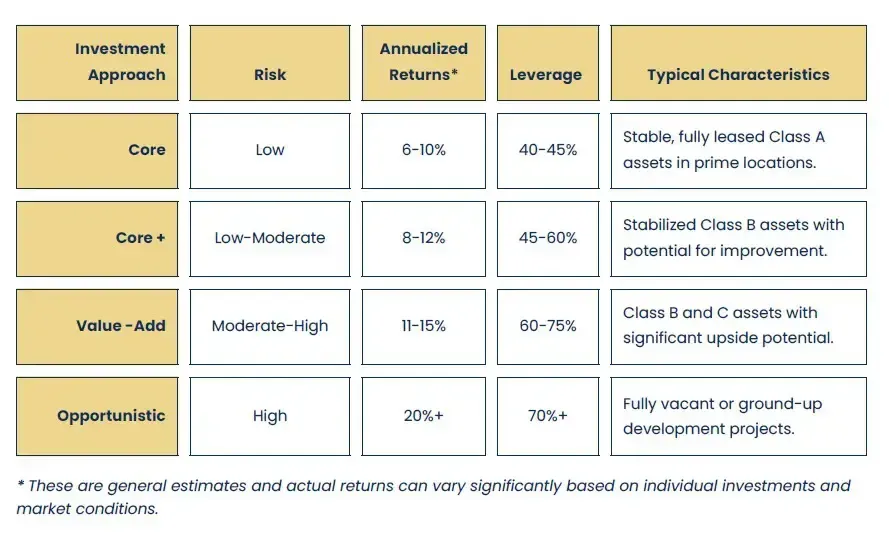

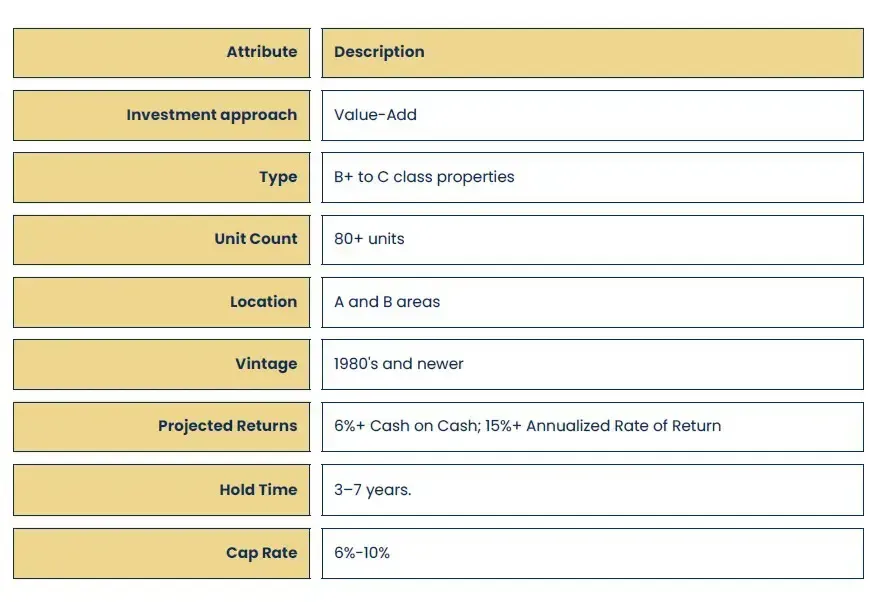

Strategies and Our Criteria

Real estate is a complex asset class and returns and risks can vary significantly based on factors like location, property type, economic conditions, and the specific strategies employed. However, CRE investment strategies can be generally categorized in the following four approaches.

Facebook

Instagram

LinkedIn